It's Never Too Late to

Work Toward Your

Dreams

What do you want out of retirement? What do you want to leave behind? We can help you use the nest egg you’ve built to fund your retirement future.

The right way to retire is to RetireBright

At BrightGuide Financial, our mission is to help light a clear path toward your ideal retirement, and we believe that only happens in the presence of exceptional planning, education, and service.

We created an intentional, four step process to help our clients RetireBright.

Wisdom – The application of knowledge, experience, common sense, and insight.

Income – Reliable and stable income sources that cannot be outlived.

Strategy – The art of risk mitigation, cost reduction, and gained efficiency over time.

Execution – The oversight and management of processes, service, and results.

Instant Download

Set the Right Goals for a Future You’ll Love.

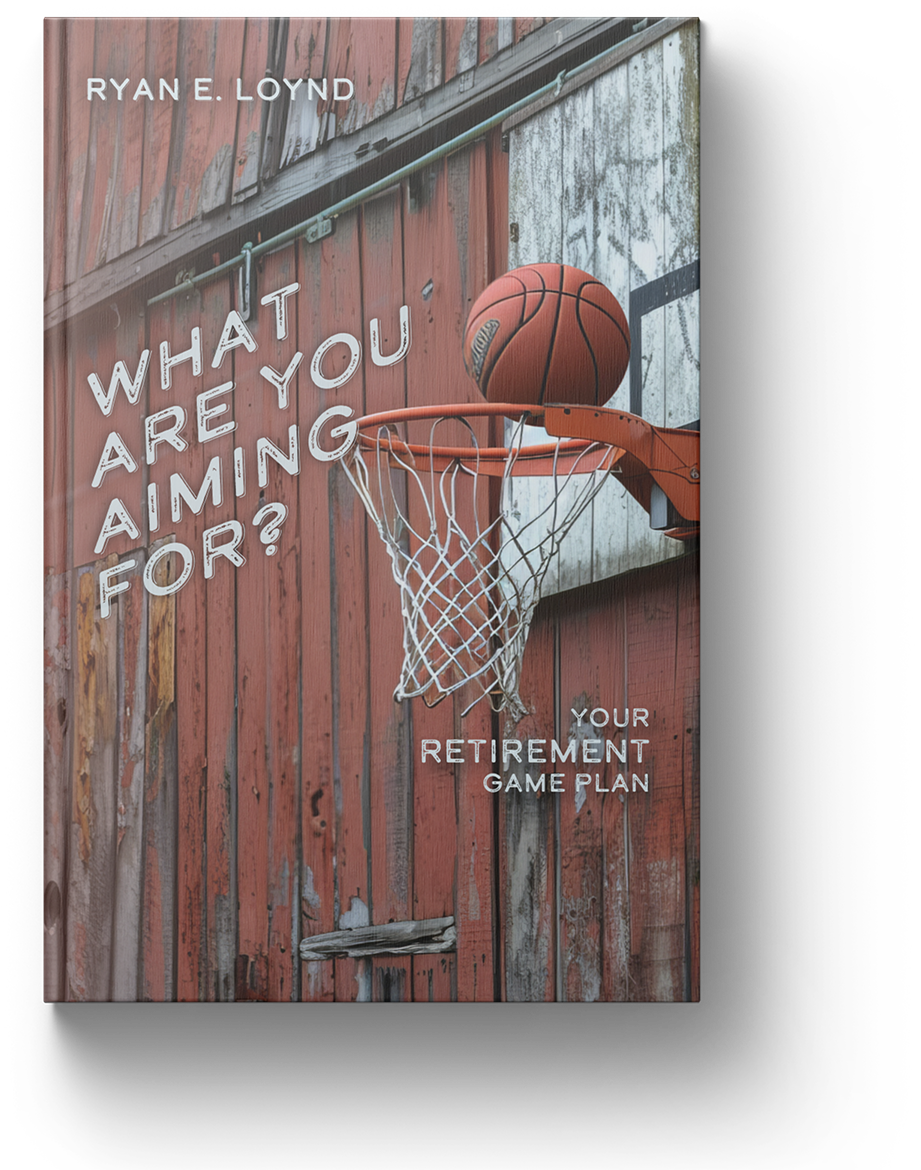

Are you aiming at the right target for your future? Ryan E. Loynd’s book, “What Are You Aiming For? Your Retirement Game Plan,” is your guide to setting achievable goals, navigating life’s surprises and using proven strategies to build the retirement you’ve worked for and deserve.

Ryan discusses some of the most pressing challenges facing retirees and those nearing retirement today, including:

- Adjusting retirement goals to align with the future you truly want.

- Taking a comprehensive approach to achieve a secure, fulfilling retirement.

- Preparing for life’s unexpected twists to safeguard your retirement plans.

Meet Our

Founder & Wealth Advisor

Ryan Loynd founded BrightGuide Financial in 2019 because he has a passion to change the financial services landscape through comprehensive planning, client education, proactive communication and elite service. Check out Our Team to learn more about Ryan and the group of dedicated professionals he’s assembled to help guide you to your ultimate retirement destination.